My Bitcoin are just like any other:

- Just like yours, they do (not) exist.

- Just like yours, they have the same inherent drawbacks.

- Just like yours, they have the same inherent advantages.

Some of Bitcoins drawbacks have been addressed and resolved in alternative crypto-currencies and although most of what I write will be just as true for many other crypto-currencies I use the term Bitcoin, because it’s renown. It’s a brand. It’s adopted.

Current market prices and rates

Recently it has become increasingly expensive to receive fiat money in exchange for Bitcoin.

You currently get more Bitcoin for the same amount of fiat money (USD/EUR/[name your favorite branded piece of Cellulose here]).

Now, word on the street has it that one of the reasons for the situation might be “speculators checking out”.

“Speculators checking out” means that a certain amount of short-term thinking is removed from the market. Perfect. This is likely to serve Bitcoins stability which, in turn, can stimulate it’s actual market usage.

Looked at it in a (very) basic fashion, furthermore that also means:

- People who consider a fiat currency a mean of value determination revert back to that form of holding their assets (for any period currently desired).

- People who consider crypto-currencies a mean of value determination now get much more “bang for the buck”.

Technically, as with any market, it boils down to one single thing:

Perception of value is shifting.

“How many bottle caps for one BTC?”

War has reached Western Europe.

Actual combat operation and overt hostility are fortunately still a day drive (only a day drive?!) away from most “Western European” borders. Effects are noticed regardlessly.

The increasing amount of refugees in Western Europe underlines the proximity of combat. Surprisingly, little to zero concern is noticed, indicating that the population still considers it “remote”. I, in turn, like to ask the question:

“Did those refugees flee far enough already?”

Given this uncertain situation it is yet to be seen how things will unfurl and how they affect values. First and foremost I am curious about the development of perceived value of fiat currencies. (For logical reasons, some prefer to call those “war currencies”.)

- Will certain geographical areas be forced to substitute those with “ridiculous” things like bottle caps? It has happened before.

- How will crypto-currencies affect trade in war zones? How will they be valued and used?

Especially in times like these, things with inherent values gain in perceived value. Crypto-currencies will shine through aspects like the following:

- Capped supply

- Location independence (globally accepted and available)

- Jurisdiction independence

So why do my Bitcoin value more than yours?

Speculators keep assets hoping on higher perceived value in the future. They want to “cash in” on those gains.

For me and many others, right at this very moment I consider Bitcoin to be worth much more than the fiat currently offered at the markets.

Although these two mindsets might seem very similar, they cause very different actions.

While speculators will be tempted to sell in order to keep their “losses” low (what are they “loosing” anyway?), we will keep them even if we could potentially “buy back” more tomorrow – a guessing game I deny to take the risk for.

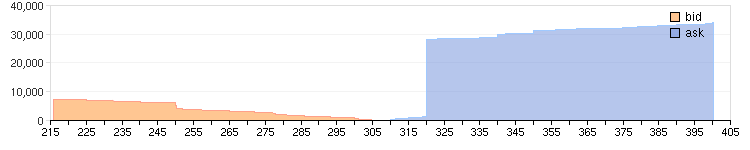

Meanwhile, I actually enjoy looking at charts like this one:

Tell ancient China that somebody built this one with the click of a mouse.